Understanding Water Backup and Sump Overflow Endorsements

September 20, 2023

Homeownership is a huge investment, and protecting it from unexpected events is crucial. While standard homeowners insurance policies offer essential coverage, they may not always include protection against water damage caused by sump pump overflows or sewer backups. To safeguard your home comprehensively, it’s very important to understand and consider adding a water backup and sump overflow endorsement to your policy.

What are the Risks: Water damage can wreak havoc on your home and personal belongings. Two common culprits are sump pump overflows and sewer backups.

Sump Pump Overflow

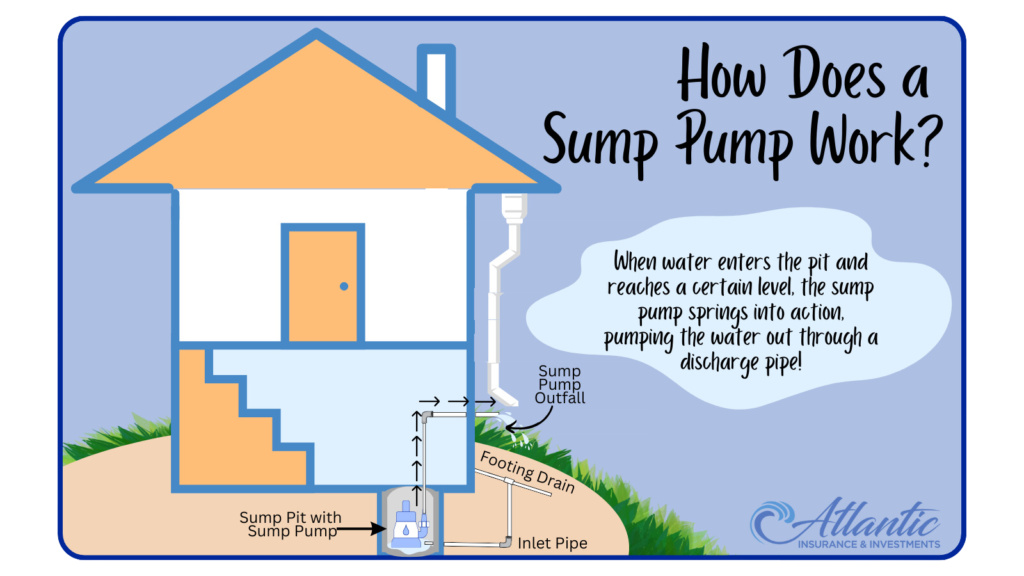

First, what is a Sump Pump? A sump pump is a device designed to maintain a dry and moisture-free basement environment. It achieves this by efficiently removing excess water from a designated pit or basin, typically located in the lowest part of your basement where water naturally accumulates.

How Does a Sump Pump Work? The concept is straightforward: when water enters the pit and reaches a certain level, the sump pump springs into action, pumping the water out through a discharge pipe. This simple yet effective mechanism prevents basement flooding and safeguards your home from moisture-related issues like mold and mildew.

Common Causes of Sump Pump Overflow

Understanding why sump pumps may fail is essential for preventing potential issues. Here are some common causes of sump pump overflow:

- Power Outages: When there’s no electricity, your sump pump cannot function properly, leading to water accumulation in your basement.

- Overwhelmed System: Heavy rainfall or rapid snowmelt (not likely in our area) can inundate the pit, exceeding the pump’s capacity.

- Mechanical Issues: Malfunctioning float switches, stuck check valves, or clogs in discharge pipes can disrupt normal pump operations.

The dangers of sump overflow include property damage, mold growth, electrical hazards, fire risk and health concerns.

Sewer Backup

First, what is a Sewer Backup? Sewer backups occur when sewage flows back into your home through drains, toilets, or sinks. This can result from clogged sewer lines, heavy rain, or tree root intrusion. Cleanup and repairs from a sewer backup can be expensive and unsanitary.

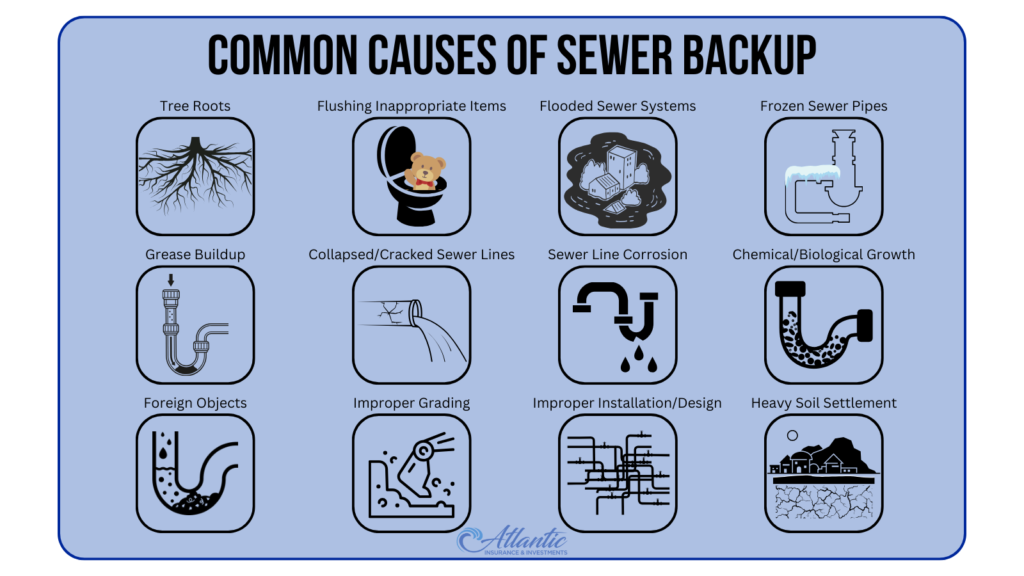

Common causes of Sewer Backup: Sewer backups can be incredibly disruptive and damaging. Understanding the common causes of sewer backups can help homeowners and property managers take preventive measures to avoid these issues. Here are some common causes of sewer backups:

Blockages from tree roots, grease buildup, foreign objects, flushing inappropriate items, collapsed or cracked sewer lines, improper grading, flooded sewer systems, sewer line corrosion, improper installation or design, frozen sewer pipes, chemical and biological growth, and heavy soil settlement.

Preventing sewer backups involves proper maintenance, responsible disposal practices, and, in some cases, professional inspections and repairs. Regularly inspecting and cleaning sewer lines, disposing of grease and inappropriate items in designated containers, and being mindful of what goes down the drain can help reduce the risk of sewer backups. Additionally, consulting with plumbing professionals for periodic inspections and maintenance can be a proactive measure to prevent sewer issues.

Water backup and sump overflow endorsements are essential additions to homeowners insurance, providing valuable protection against water damage events that standard policies may exclude. Before purchasing this endorsement, it’s important to review your specific needs, understand the terms, and consult with your insurance agent. By taking these steps, you can better safeguard your home and belongings from the costly consequences of water damage caused by sump pump overflows and sewer backups.

Questions about your homeowners insurance in SC or NC? Call Kristin Simpson.

Call or Text (803)261-4186 or Email: kristin@atlantic-ii.com

Spring Home Maintenance

April 1, 2023

After a long dark and cold winter, the bright sun and warm winds of the spring are a breath of fresh air!

The only downside? All that sunlight helps you see your leaf-filled gutters, cracked sidewalks, and dead plants in the flower beds. Get your home in shape for spring with this checklist!

- Examine Roof Shingles: Examine the roof to see if any shingles were lost or damaged under the winter snow and ice.

- Check the Gutters: Loose or leaky gutters can cause improper drainage, which can lead to water in your basement or crawlspace during the spring rain.

- Inspect the Concrete: Inspect concrete slabs for signs of cracks or movement. Fill cracks with concrete crack filler or silicone caulk, power-wash, and then seal the concrete.

- Remove Firewood: Firewood stored near the home for winter should be moved at least 18 inches off the ground and at least 2 feet from the structure.

- Check Outside Faucets: Check outside faucets for freeze damage. While you’re at it, check your garden hose for dry rot.

- Repair Window Screens: You will want to open the windows to let the fresh air in. Ensure small holes and tears are repaired so bugs don’t get in.

This is just a short list of items you can do to prepare your home for the spring. Winter was nice and cozy but we are ready for the spring sunshine! While you are preparing your home for the spring, it is a great time to review your homeowners insurance!

Source: https://www.hgtv.com/lifestyle/clean-and-organize/10-home-maintenance-tips-for-spring-pictures

September Is Life Insurance Awareness Month

September 7, 2020

As I am sure most of you are thinking “There really is a month/day for everything!” Yes there is, and September is life insurance. I want to dispel a few myths regarding life insurance.

Myth 1: It’s expensive.

The biggest misconception about life insurance is its cost. There are many affordable plans available. Plans range in price based on a few factors but many are surprised how reasonably priced plans currently are right now.

Myth 2: If you are young and healthy, you don’t need it.

Your life insurance needs depend on many factors, but if possible, it’s better to buy a policy when you’re young and healthy and it costs the least. As you get older you are more likely to develop health problems and the price goes up.

Myth 3: If you have health issues, you can’t get it.

Unless you have severe health conditions, you generally can buy term life insurance. Conditions such as diabetes, high cholesterol and arthritis will mean higher life insurance quotes, but insurance could still be within reach.

Myth 4: If you are a stay-at-home parent you don’t need it.

If you die, who’s going to take care of your children, elderly parents and even your pets? Your surviving spouse may need to hire help, and insurance benefits could help pay for these costs. Stay-at-home parents provide a tremendous benefit to the family, and that void is expensive to fill.

Myth 5: Life insurance through your employer is sufficient.

Group life insurance is a great employer benefit, but typically the payout is fairly low, perhaps twice your base salary. That may not be enough to provide for a young family. Plus, what if you lose or leave your job? A workplace policy doesn’t travel with you, so a personal policy is the safest way to ensure your family is taken care of.

If life insurance is something you are interested in please give me a call. I can give you a quote in a matter of minutes.

Why choose Atlantic Insurance?

August 7, 2020

The main reason why our clients choose Atlantic Insurance is because we are an independent agency. That means we offer more insurance options along with a wide variety of coverage selections and prices. We will do the shopping for you! At Atlantic Insurance we will make sure you are getting the best policy at the best price.

Atlantic Insurance works with multiple lines and carriers. This means we can offer more products that can best meet all your needs. You can get auto, home, health, life, business insurance and more, all in one place, with the help of one agent. To learn more about what we offer please visit our website.